Author: Mr.Davor Folkenfolk

Direct-to-Home (DTH) entertainment, where video programming is delivered to the consumer through geostationary satellites, has been a popular choice for decades. The popular system offered hundreds of channels to consumers, who could use different types of subscriber models to get the programming that they wanted directly to the home.

DTH created a social culture around programming. With its set schedule, viewers could watch shows at night and talk about them with coworkers the following day. Season finales and special programming became events, leading to social media buzz, excited conversations, and debates about characters and plot twists.

Over-the-Top (OTT) programming provided consumers with a different, more personal option. These services, which include Netflix, AppleTV, and Amazon Prime are available on a subscription model. OTT subscribers quickly found that they were no longer tied to network schedules; they could view the shows that they liked, at a pace they preferred. The service was much more personal than DTH, as viewers controlled the programming on their TV, as well as the device they used to watch.

A Growing OTT Market

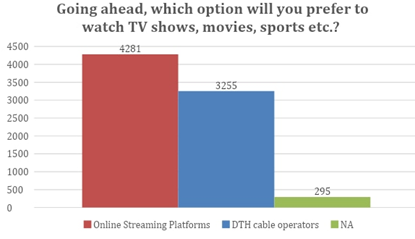

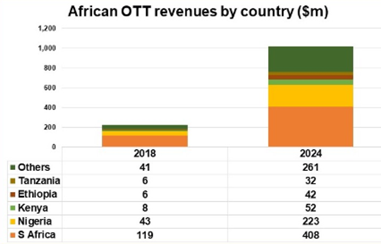

Over the past few years we’ve seen continued global growth of OTT subscribership. Last October a survey in India showed that 55% of Indians preferred OTT over DTH. The Sub Saharan African OTT video market is accelerating quickly, and expected to become a trillion-dollar market within the next 4 years.

Reported by TRAI ( Telecom Regulatory Authority of India)

Reported by Digital TV Research

OTT has a number of advantages over DTH. For one, as the cost of data has dropped globally, more subscribers can afford the fast internet speeds required to service an OTT service. Couple that with convenience of anytime-anywhere viewing options and add in the seemingly high price of DTH services, and you have a strong case for OTT services.

There are currently hundreds of OTT players in the market, with dozens crowding the African market.

DTH Response Pressures Broadband Providers

As you would imagine, DTH providers have noticed the changing trends in the marketplace. Whereas they once may have viewed OTT services as supplemental to the live news and sports programming that they offered, today’s consumer can purchase OTT packages for live programming. This new reality has pushed DTH service providers to adjust their offering.

SAIRTEK, Azam TV, Globecast and Canal + are just a few examples of DTH service providers who have added OTT services to their offering. In the battle to hold on to consumers, service providers like these believe that OTT services can help them retain their subscriber base. Their viewers can watch programming on any device and have control over their viewing schedule.

MNOs and ISPs are now finding themselves in a battle for market share. DTHs, with the addition of OTT services to their offering, are swaying consumers, frustrating these broadband providers.

However, MNO and ISP broadband providers have the resources and existing infrastructure to push back against DTH providers, and either partner with OTT players or create an OTT offering of their own.

Finding the Right Price Point

MNOs and ISPs have an advantage in their battle over customers. Their broadband services are already designed to support OTT viewing. DTH service providers, on the other hand, have to manage additional expenses into the equation.

For DTH providers to provision OTT services that don’t suffer from latency issues, lag time, or constant interruptions as data is loaded into the system requires high bandwidth running via satellite, which has higher costs than using fiber technology. These put upward pressure on DTH pricing, limiting the types of OTT services they can offer while remaining competitive.

However, the broadband providers, with their existing VSAT services, are technologically better equipped to furnish OTT to consumers, and maintain market share. With the bi-directional access needed to fully support OTT programming, MNO and ISP broadband providers are able to stave off inroads made by DTH providers. These service providers can utilize their existing CDN networks and adapt their data centers to deliver OTT programming to consumers.

MNOs and ISPs Need to Act

The advantage held by MNOs and ISPs won’t last long. DTH providers are working tirelessly to create and provision OTT offerings at a price that consumers will have trouble passing. To protect against churn, MNOs and ISPs must create OTT packages and offerings that engender consumer loyalty and builds relationships between the consumer and the service provider.